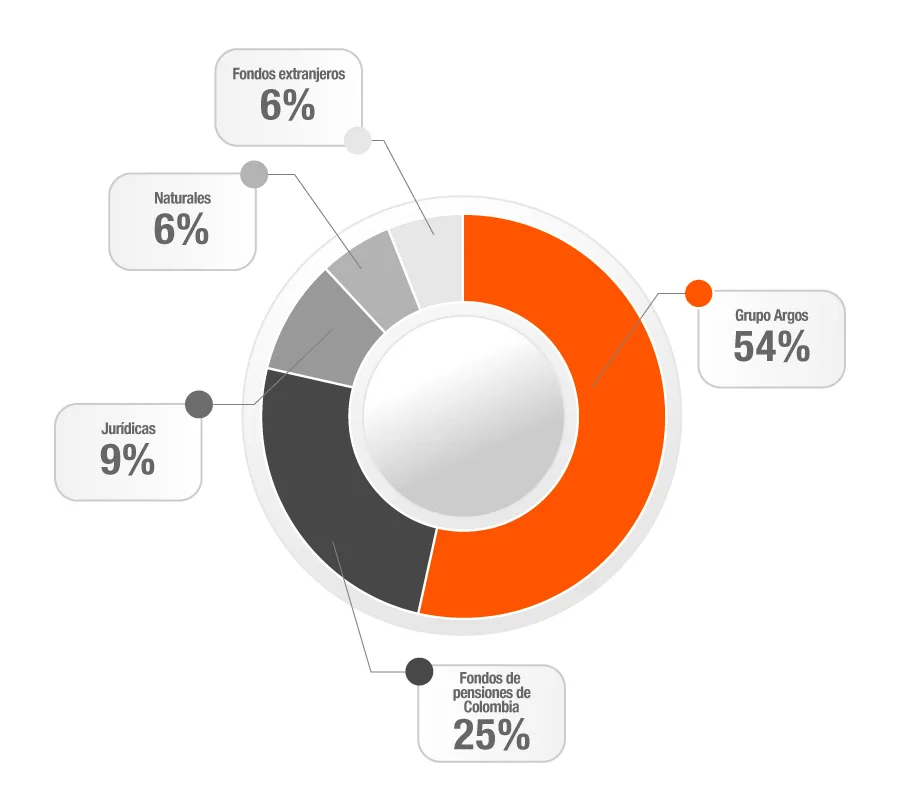

Celsia Shares

Our stock is included in the investment portfolios of the country’s pension and severance funds. This way, thousands of Colombians benefit from our growth and profitability.

The government holds no more than 5% of the structure.

Celsia’s share capital is divided into 1,069,972,554 common shares. Each common share represents one vote in the General Shareholders’ Assembly, meaning the highest corporate body consists of 1,069,972,554 votes.

The actual number of outstanding shares is subject to the development of the share repurchase program, which can be consulted at the following link.

Main Shareholders

June 2025

| SHAREHOLDER NAME | SHARES | % OWNERSHIP |

|---|---|---|

| GRUPO ARGOS S.A. | 566.360.307 | 54,38% |

| FONDO DE PENSIONES OBLIGATORIAS PORVENIR MODERADO | 85.590.667 | 8,22% |

| FDO DE PENSIONES OBLIGATORIAS PROTECCION MODERADO | 68.630.632 | 5,59% |

| FONDO BURSATIL ISHARES MSCI COLCAP | 32.520.514 | 3,12% |

| C.V.C. CORPOR. AUTONOMA REGIONAL DEL VALLE DEL CAU | 28.250.607 | 2,71% |

| FONDO DE PENSIONES OBLIGATORIAS COLFONDOS MODERADO | 22.673.901 | 2,18% |

| FONDO PENSIONES OBLIGATOR. PORVENIR MAYOR RIESGO | 14.447.228 | 1,39% |

| FONDO DE PENSIONES OBLIGATORIAS PROTECCION MAYOR R | 13.553.491 | 1,30% |

| FONDO BURSATIL HORIZONS COLOMBIA SELECT DE S&P | 11.423.187 | 1,10% |

| PI-CELSIA FONDO DE PENSIONES PROTECCION | 10.861.301 | 1,04% |

| FONDO DE CESANTIAS PORVENIR | 7.271.156 | 0,70% |

| UTILICO EMERGING MARKETS TRUST PLC | 7.233.048 | 0,69% |

| SKANDIA FONDO DE PENSIONES OBLIGATORIAS -MODERADO | 7.191.240 | 0,69% |

| FONDO DE CESANTIAS PROTECCION- LARGO PLAZO | 6.564.798 | 0,63% |

| UNIVERSIDAD DE MEDELLIN | 6.549.688 | 0,63% |

| FDO PENS OBLIGATORIAS COLFONDOS MAYOR RIESGO | 4.456.978 | 0,43% |

| POLAR S.A.S | 4.400.000 | 0,42% |

| PA 2016080014 | 3.662.711 | 0,35% |

| GLOBAL X MSCI COLOMBIA ETF | 3.283.435 | 0,32% |

| FONDO PENSIONES OBLIGATORIAS PORVENIR CONSERVADOR | 3.246.621 | 0,31% |

| CAMBRIA GLOBAL VALUE ETF | 2.960.964 | 0,28% |

| FONDO DE PENSIONES OBLIGATORIAS PROTECCION CONSERV | 2.496.362 | 0,24% |

| AGROINVERSIONES LUCERNA Y CIA S.C.A | 2.148.500 | 0,21% |

| COMPAÑIA DE SEGUROS BOLIVAR S.A. | 2.138.742 | 0,21% |

| BANCO BTG PACTUAL SA CAYMAN BRANCH – APT | 2.137.990 | 0,21% |

| OTROS ACCIONISTAS (27,698) | 121.470.487 | 11,66% |

| TOTALES | 1.041.524.555 | 100,00% |

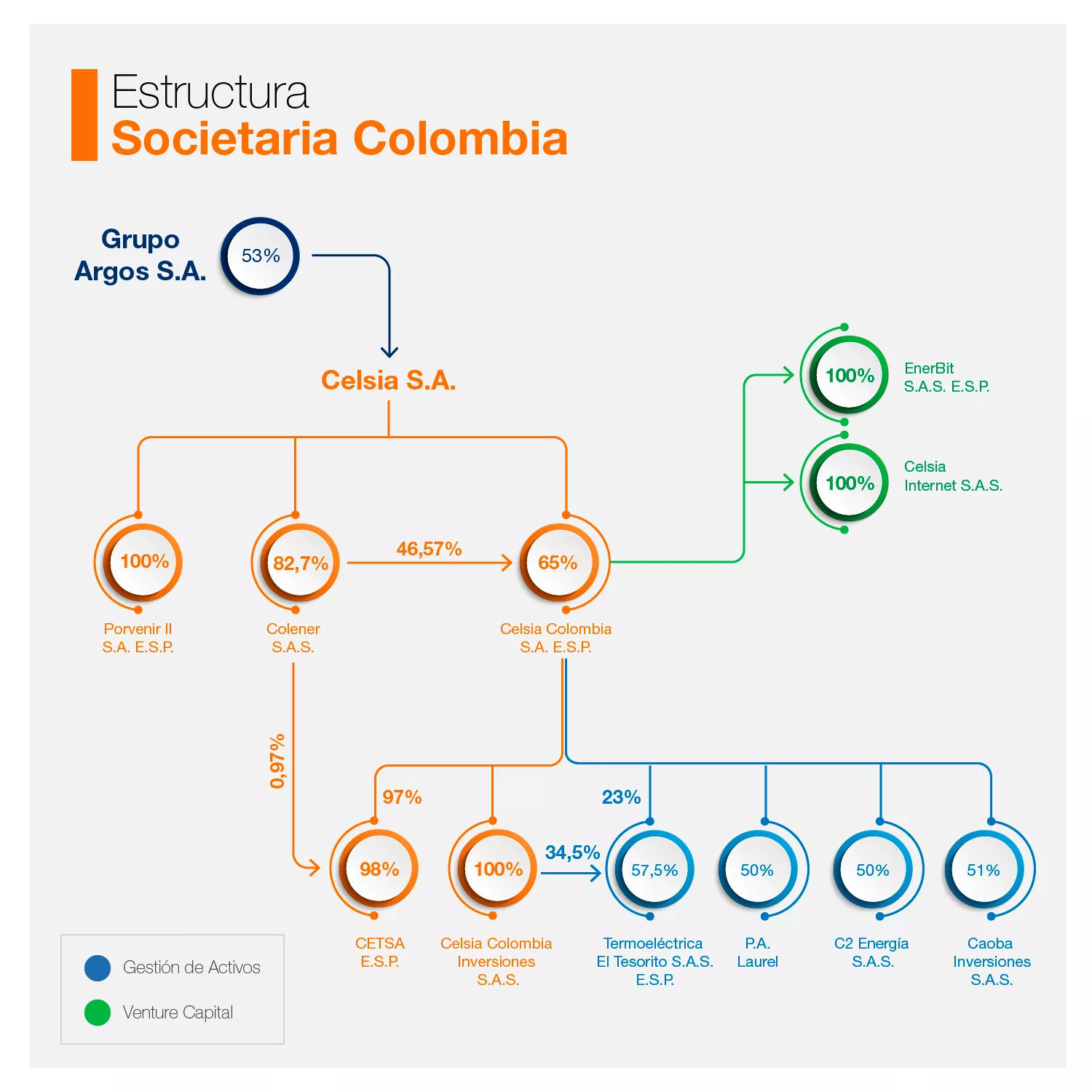

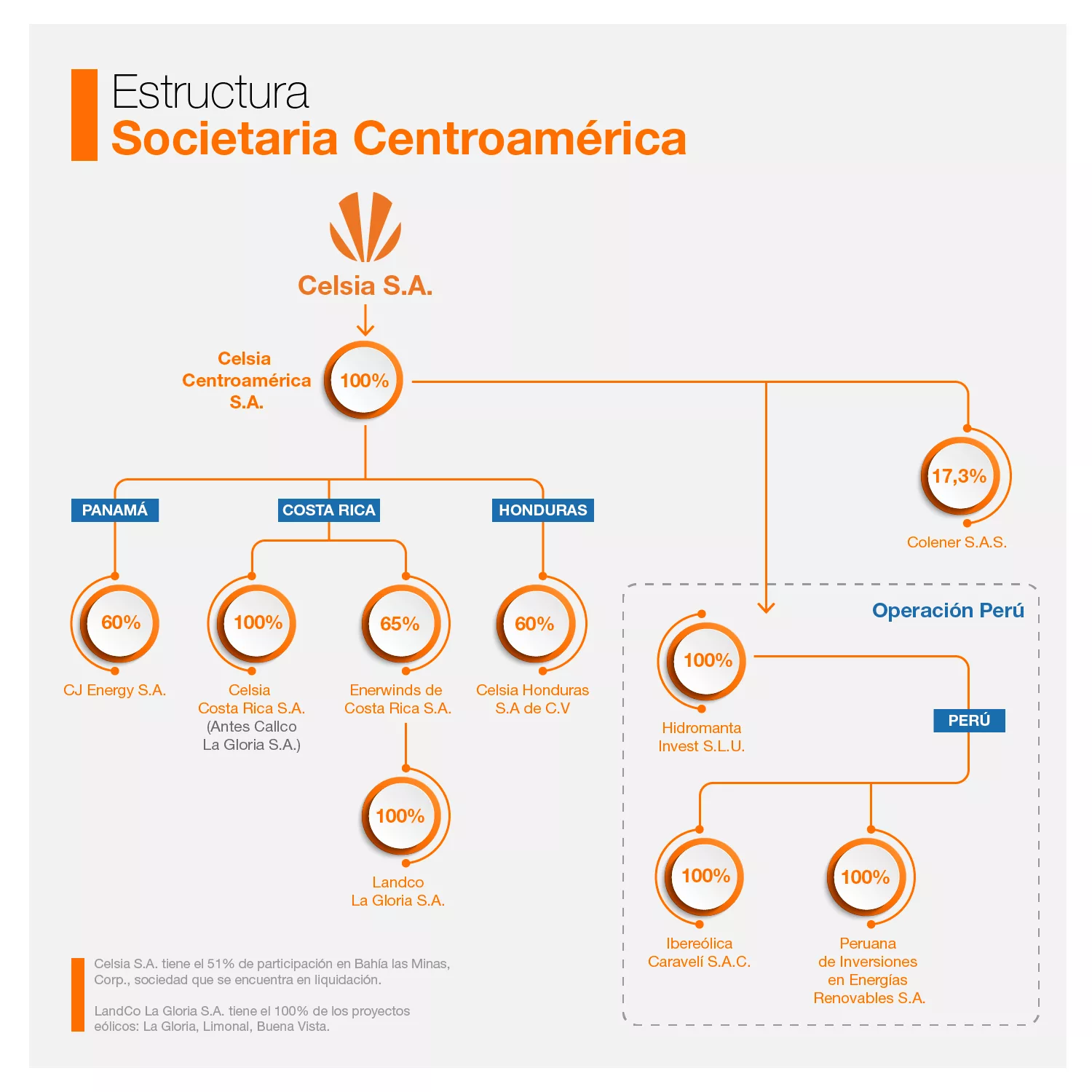

Grupo Argos S.A. holds a 52.93% equity stake in the subscribed and paid-in capital of Celsia, thereby establishing, under the terms of Article 26 of Law 222 of 1995, a control situation over Celsia and any companies in which it holds more than 50% of the subscribed and paid-in capital. This control situation is duly registered in the commercial registry. Grupo Argos S.A. conducts its business through a group of subordinate companies that enable the proper execution of its MEGA strategy.

Celsia is part of the Argos Business Group, whose parent company is Grupo Argos S.A. To view information about Grupo Argos S.A., click here.

Stock Performance (Equity)

View the Celsia Share Issuance Prospectus here.

Celsia’s Capital and Number of Common Shares

| Company Capital | Number of Shares | Nominal Value | |

|---|---|---|---|

| Authorized | $300,000,000.00 | 1,200,000,000 | $0.25 |

| Subscribed | $267,493,138.50 | 1,069,972,554 | $0.25 |

| Paid | $267,493,138.50 | 1,069,972,554 | $0.25 |

The company holds 130,027,446 shares in reserve.

To learn more about the share repurchase process, click here